Accounts Receivable Overview, Why, Risks

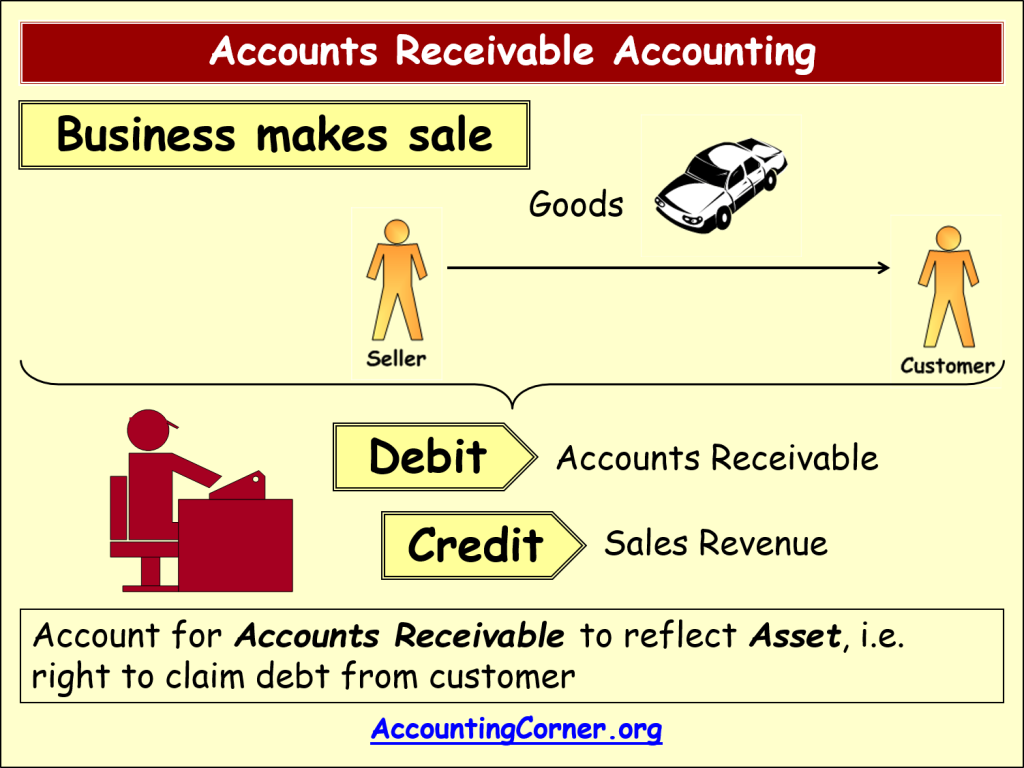

During that time, the company would record $5,000 in their accounts receivable. When Jane pays it off, the money would go back to the sales amounts or cash flow. The journal entry reflects that the supplier recognized is this tax deductible medical expenses the transaction as revenue because the product was delivered, but is waiting to receive the cash payment. Hence, the debit to the accounts receivable account, i.e. the manufacturer owes money to the supplier.

Accounting for Early Payment Discounts

Automating aspects like invoice generation, payment processing, and late payment reminders makes it easy to maintain a prompt and consistent AR process. This improves the likelihood of payment and enhances the customer experience. Day Sales Outstanding, or DSO, measures the time it takes your Accounts Receivable team to collect an invoice payment. It’s a valuable indicator for assessing the efficiency of your collections process and the credibility of your customers. If the customer were to later pay the invoice, ABC would simply reverse the entry, so that the allowance account is increased back to its former level.

Part 2: Your Current Nest Egg

Your business may choose to accept some or all of these payment methods as outlined in your sales order and invoice. Having a clear process for managing overdue payment collections ensures that you have the proper documentation if you need to seek formal collections support. Accounts Receivable (AR) is the money that customers owe to a business for goods or services provided. When customers make a purchase on credit, that debt is added to the business’s Accounts Receivable.

- Often, a business offers this credit to frequent or special customers who receive periodic invoices.

- Accounts payable on the other hand are a liability account, representing money that you owe another business.

- You might want to give them a call and talk to them about getting their payments back on track.

- Now that you know what a successful Accounts Receivable process is and why it’s valuable, you might be wondering how to get started.

- Since the unmet payment obligation represents a future economic benefit to the company, the accounts receivables line item is categorized as a current asset on the balance sheet.

Traditional vs. Modern Accounts Receivable

The provider may find it hard to collect payment perpetually every time someone makes a call. Instead, it will bill periodically at the end of the month for the total amount of service used by the customer. Until the monthly invoice has been paid, the amount will be recorded in accounts receivable. Accounts Receivable (AR) represents the credit sales of a business, which have not yet been collected from its customers. Companies allow their clients to pay for goods and services over a reasonable extended period of time, provided that the terms have been agreed upon. For certain transactions, a customer may receive a small discount for paying the amount due to the company early.

Impact of Accounts Receivable on Companies

As your business grows, the volume of Accounts Receivable payments that you process will increase. Automating aspects of your accounts receivable—such as invoicing and late payment reminders—frees up time and energy to focus on other aspects of your business. It sets in motion the payment process and outlines payment terms, encouraging customers to promptly pay their debts. Ensuring you send invoices promptly sets a strong foundation for the rest of the Accounts Receivable system to proceed. Company B now owes Company A money, so it lists the invoice in its accounts payable column. While Company A waits to receive the money, it records the amount in its accounts receivable column.

The customer credit assessment step helps businesses choose customers who are more likely to pay reliably and on time. When it becomes clear that a receivable won’t be paid by the customer, it has to be written off as a bad debt expense or a one-time charge. Companies might also sell this outstanding debt to a third party debt collector for a fraction of the original amount—creating what accountants refer to to as accounts receivable discounted.

Ready to learn how to handle your accounts receivable like a pro and get paid by customers? Non-trade receivables, on the other hand, arise from transactions that are outside this normal line of activity. The net cash impact is negative since the days sales outstanding (DSO) is increasing each period. Starting from Year 0, the accounts receivable balance grew from $50 million to $94 million in Year 5, as captured in our roll-forward. However, the manufacturer is a long-time customer with an agreement that provides them with 60 days to pay post-receipt of the invoice. On the cash flow statement (CFS), the starting line item is net income, which is then adjusted for non-cash add-backs and changes in working capital in the cash from operations (CFO) section.

Usually the longer the overdue the more likely that the customers are not going to pay back the money. Allowance for doubtful accounts is used for making provisions on the receivables. As a result, the amount of receivables is reduced by the provisioning amount.