Depreciable Basis Cost, Salvage Value, Calculation, Examples

All of our content is based on objective analysis, and the opinions are our own. Three reasons cited for this assumption were the lack of materiality, the inability to estimate salvage value with reliability, and the fact that salvage value can usually be ignored for tax purposes. In fact, a major survey revealed that 59% of companies simply assume a salvage value of zero. It’s a strategic tool that, when understood and applied correctly, can lead to more informed and profitable decisions in the finance industry. Manufacturing and EquipmentIn manufacturing, machinery often has a significant salvage value, impacting budgeting and investment decisions.

How is Salvage Value Calculated?

Even if the company receives a small amount, it may be offset by costs of removing and disposing of the asset. The residual value of a car is the estimated value of the car at the end of the lease. The residual value of a car is calculated by the bank or financial institution; it is typically calculated as a percentage of the manufacturer’s suggested retail price (MSRP). Salvage value is important in accounting as Bookkeeping for Chiropractors it displays the value of the asset on the organization’s books once it completely expenses the depreciation.

Assets in Accounting: Types, Identification, and Easy Calculation Methods

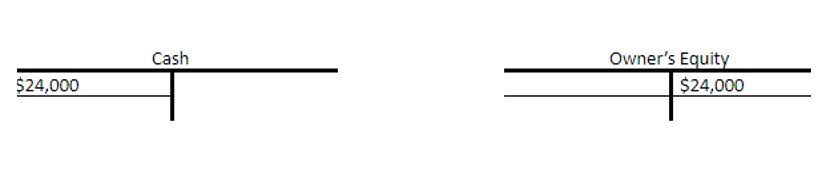

To calculate the annual depreciation expense, the depreciable cost (i.e. the asset’s purchase price minus the residual value assumption) is divided by the useful life assumption. If a company wants to front-load depreciation expenses, it can use an accelerated depreciation method that deducts more depreciation expenses upfront. Many companies use a salvage value of $0 because they believe that an asset’s utilization has fully matched its expense recognition with revenues over its useful life. Book value versus salvage value is the point of difference between asset valuation in accounting and finance.

Calculation of Salvage Value

- Another example of how salvage value is used when considering depreciation is when a company goes up for sale.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- Get instant access to video lessons taught by experienced investment bankers.

- Along with interest rate and tax, the residual value is an important factor in determining the car’s monthly lease payments.

- Be mindful that for assets with a low salvage value and high cost to dispose of, it is entirely possible to have a negative residual value.

So resale value refers to the value of a purchased car after depreciation, mileage, and damage. While residual value is pre-determined salvage value example and based on MSRP, the resale value of a car can change based on market conditions. If you lease a car for three years, its residual value is how much it is worth after three years.

- Deskera ERP provides comprehensive asset management features that streamline the tracking, depreciation, and eventual disposal of assets.

- Third, companies can use historical data and comparables to determine a value.

- Resale value is a similar concept, but it refers to a car that has been purchased, rather than leased.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- Scrap value is the estimated cost that a fixed asset can be sold for after factoring in full depreciation.

- Salvage value is an important concept in accounting and forecasting a company’s financials.

It can be calculated if we can determine the depreciation rate and the useful life. For tax purposes, the depreciation is calculated in the US by assuming the scrap value as zero. When a company purchases an asset, first, it calculates the salvage value of the asset.

Tax laws, particularly in the U.S. and Europe, require accurate reporting of salvage values for depreciation and asset valuation. For tangible assets, such as cars, recording transactions computers, and machinery, a business owner would use the same calculation, only instead of amortizing the asset over its useful life, he would depreciate it. The initial value minus the residual value is also referred to as the “depreciable base.”